A practical guide for UAE business owners: small business accounting setup, VAT accounting UAE basics, corporate tax UAE essentials, and how to choose the best accounting app.

If you run a business in the UAE, accounting is not “back-office admin.” It’s the operating system behind cash flow, compliance, and credibility. The hard part isn’t understanding debit and credit – it’s building a simple process that works every week, even when you’re busy.

That’s why many founders are moving from spreadsheets to a business accounting app: it turns daily chaos (receipts, invoices, bank transactions) into structured records you can trust. This guide walks you through small business accounting in the UAE, including VAT accounting UAE and corporate tax UAE essentials, and what to look for in UAE accounting software.

1. Start with the “non-negotiables” of small business accounting

Before VAT returns or financial reports, you need clean foundations. Most mistakes happen because these basics were skipped.

Separate business and personal money

Open a dedicated business bank account and use it consistently. Mixing expenses is the fastest way to create messy books and painful reconciliations.

Pick one system and stick to it

Whether you start simple or go full-featured, choose one place where transactions live. The moment you have “some in the bank app, some in Excel, some in WhatsApp,” errors multiply.

A business accounting app helps because it’s designed to keep records consistent (and searchable) across months. If you’re serious about compliance, consistency beats complexity.

Create a clean chart of accounts

Keep categories simple: Sales, Cost of Sales, Marketing, Rent, Utilities, Software, Professional Fees, Travel, etc. Too many categories creates confusion; too few creates useless reporting.

2. The weekly routine that keeps your books clean

Most UAE business owners don’t need “more accounting.” They need a small routine that prevents issues from piling up.

Use an expense tracker app to capture receipts immediately

Receipts don’t go missing – they drift. They end up in camera rolls, pockets, email chains, and glove compartments. A good expense tracker app turns receipts into usable records, not just photos.

Your rule: capture receipts weekly (daily is better), and attach them to the transaction.

Use an invoicing app so cash flow doesn’t depend on memory

Late invoices = late payments. And inconsistent invoices = compliance and tracking problems. An invoicing app standardizes invoice numbering, customer details, and payment status tracking – which makes collections faster and reporting cleaner.

Your rule: invoice immediately, then review unpaid invoices once a week.

Reconcile your bank every month (minimum)

Bank reconciliation is where you catch duplicates, missing entries, bank fees, refunds, and payment processor charges. If your accounting doesn’t match your bank, it’s not accounting – it’s guessing.

This is where the best accounting app earns its keep: it makes reconciliation faster and less error-prone than manual spreadsheet matching.

3. VAT accounting UAE: what UAE business owners must get right

VAT isn’t complicated when your records are organized. It becomes stressful when you’re trying to rebuild three months of receipts and invoices at the deadline.

VAT registration thresholds (know when you must register)

In the UAE, VAT registration is mandatory if taxable supplies and imports exceed AED 375,000 (with rules covering past 12 months or expected next 30 days).

Voluntary registration can apply below the mandatory threshold, including the commonly cited AED 187,500 threshold.

VAT invoices must include required fields

VAT compliance is heavily linked to invoicing quality. The FTA’s guidance lists typical mandatory invoice elements such as the words “Tax Invoice,” supplier details and TRN, a sequential invoice number, and key dates.

This is a big reason many companies prefer UAE accounting software or an invoicing app rather than DIY templates: it reduces formatting errors and missing fields.

Record keeping matters

The UAE’s tax procedures framework includes record-keeping periods (commonly referenced as five years for many accounting records, with certain categories requiring longer).

Practical takeaway: store invoices and receipts in an organized, searchable way from day one – not in random folders.

4. Corporate tax UAE: the basics you need for clean books

Corporate tax in the UAE is now part of normal business life, which means your bookkeeping needs to support it.

Corporate tax rates

Official guidance commonly cites 0% on taxable income up to AED 375,000 and 9% above that level.

There are also specific rules for Qualifying Free Zone Persons (including 0% on qualifying income, subject to conditions).

Who is subject to corporate tax UAE rules?

The Ministry of Finance describes corporate tax as applying broadly to UAE companies and other taxable persons (with details depending on legal form and activity).

Keep records long enough

Corporate tax record retention expectations can be longer than many founders assume. The FTA has emphasized retaining relevant corporate tax records for at least seven years in certain contexts.

This is where a business accounting app (with document storage and audit trails) can be safer than scattered spreadsheets.

5. Choosing the best accounting app for UAE business owners

If you’re searching for the best accounting app, don’t start with features – start with outcomes: fewer errors, faster invoicing, cleaner compliance, better visibility.

Here’s what to prioritize in a business accounting app or UAE accounting software:

Must-haves

- Expense capture that behaves like a real expense tracker app (quick receipt capture + easy attachment + searchable storage)

- Reliable invoicing (a true invoicing app with consistent numbering and customer fields)

- Bank reconciliation support that makes monthly close realistic

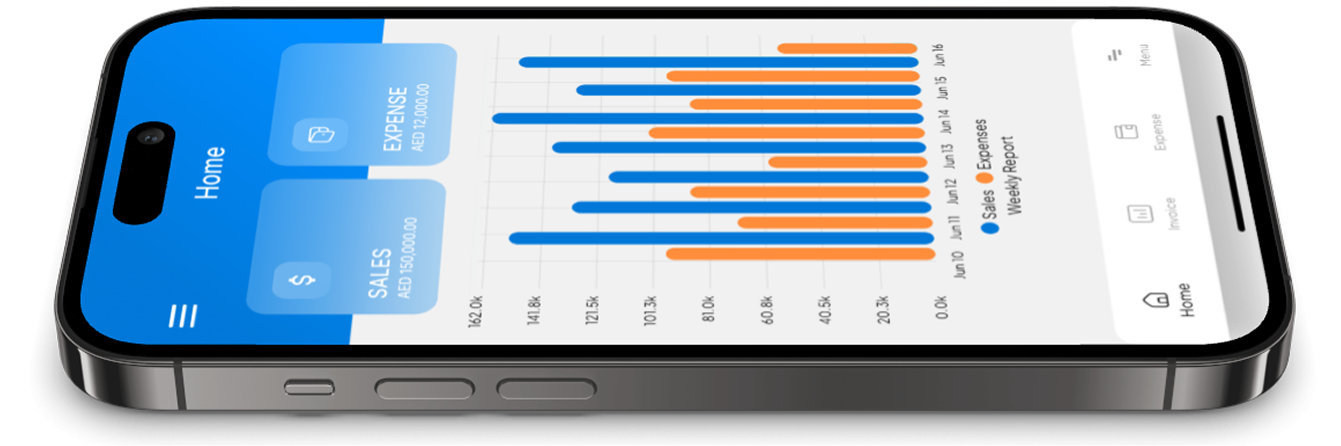

- Clear reports you can understand: profit & loss, cash flow view, outstanding invoices, expense breakdowns

- Audit-friendly storage (documents linked to transactions)

UAE-specific strengths

- Support for VAT invoice structure and fields (to reduce formatting mistakes).

- Workflows that help you stay ready for VAT accounting UAE filings and corporate tax UAE reporting.

In short: the best business accounting app should reduce decision fatigue, not add more screens to your day.

6. The “simple monthly close” checklist (copy this)

If you do only one thing each month, do this:

- Reconcile bank and payment gateway transactions

- Confirm all sales invoices are issued and tracked

- Capture and categorize all receipts

- Review VAT-related transactions and invoice compliance

- Save/organize documents for record retention expectations

- Review profit, cash position, and upcoming obligations (VAT and corporate tax planning)

This is small business accounting done like a professional – without turning your business into an accounting department.

Final word: clean books create options

Good accounting in the UAE isn’t just about avoiding penalties. It’s about building a business that can scale, borrow, attract partners, and survive surprises.

If you want a next step that’s practical: move your daily workflow into a business accounting app that includes an expense tracker app and invoicing app capabilities, and is built as UAE accounting software – so your VAT accounting UAE and corporate tax UAE needs aren’t an afterthought.